With the end of the financial year coming up, now’s a great time to get on top of your tax and super. A little planning before 30 June can help you make the most of any opportunities to reduce tax, boost your super, and avoid last-minute surprises.

This checklist outlines key things to consider and action before the financial year wraps up. It’s a simple way to stay on track and finish the year with confidence.

Tax Checklist

Here are some practical things to consider before 30 June to help you tidy up your tax position and potentially reduce your bill.

- Bad Debts: If you’re running a business, write off any bad debts that won’t be recovered before 30 June so they can be claimed.

- Employee Bonuses and Director Fees: Planning to pay employee bonuses or director fees? Make sure they’re confirmed in writing and communicated to recipients by 30 June, even if payments happen later.

- Charitable Donations: Bring forward any planned donations and have the highest-earning family member make the gift. Remember: Donations must be to registered charities; They can’t create a tax loss; and Keep receipts.

- Prepay Interest on Loans: If you have a loan for an income-generating asset (like an investment property), consider prepaying interest before 30 June to bring forward the deduction.

- Claim Work-Related or Business Costs: Bring forward costs such as repairs, stationery, or supplies by 30 June 2025. These small deductions can add up. This applies to all taxpayers, not just businesses.

- Prepay Expenses: You can claim prepaid expenses, such as insurance or subscriptions.

Where the expenses is: Under $1,000 – all taxpayers can claim the expense; and over $1,000 – fully deductible if you’re a small business. - Write Off Old Stock: If you hold stock, write off any damaged, outdated or unsellable items before 30 June 2025.

- Review Assets and Depreciation: Small businesses (turnover under $10m) can immediately deduct assets under $20,000 that were acquired from 1 July 2024 and ready to use by 30 June 2025.

Also, remove any old equipment from your depreciation schedule if it’s been sold, thrown out, or is no longer usable. - Electric Vehicles: If your business provides an electric vehicle to an employee, you may be eligible for depreciation deductions and Fringe Benefits Tax (FBT) concession.

- Defer Income: If you’re planning to sell an asset for a gain, consider delaying until after 30 June if it makes sense for your broader financial situation.

- Personal Services Income (PSI): If you’re working in your own name (like a contractor or freelancer), check that your income qualifies as a business under PSI rules.

- Business Losses: If you’re working in your own name (like a contractor or freelancer), check that your income qualifies as a business under PSI rules.

- Company Loans to Shareholders (Division 7A): If you’ve borrowed from your company, the loan needs to be properly documented, put on commercial terms and repaid. If repaying through dividends, make sure the dividends are legally declared and paid prior to 1 July (with appropriate documentation in place).

- Trust Distributions: If you’re a trustee, resolutions must be made before 30 June to properly distribute income to beneficiaries. You also need to let your beneficiaries know what they’re entitled to.

- Beneficiary TFN Reporting: If new beneficiaries gave you their TFN between April-June, you must lodge a TFN report by 31 July 2025.

- Motor Vehicle Logbook: Planning to claim car expenses using the logbook method? Start now and track 12 weeks using (can span over two tax years). Also record your odometer readings.

- Private Health Insurance: Make sure you have the right level of cover to avoid the Medicare Levy Surcharge, especially if your family situation has changed (e.g. new baby, separation, adult children moving off your policy).

- Check your Insurance Cover: Review your personal and business insurance needs. Not only does this provide peace of mind, some policies may also be tax deductible, especially if prepaid.

- Review your Business Structure: Is your current set-up still the right one? Changes in income, family, or risk levels may mean a trust, company, or restructure could be more effective. We can help you weigh up your options.

Super Checklist

Make the most of your super before 30 June 2025 with these smart, simple tips.

- Check your Contribution Limits: Before adding more to super, log into myGov > ATO > Super > Information to check how much you’ve already contributed. If you’re in an SMSF, your information may not be up to date in myGov, but we can help you work this out.

- Add to Super and Claim a Tax Deduction: You may be able to make a personal deductible contribution and claim it at tax time. To be eligible: You must be over 18; if you’re 67-74, you must meet the work test or qualify for a work test exemption; and if you’re over 75, you must contribute within 28 days of your birthday month. To claim a tax deduction, submit a Notice of Intent to Claim a Deduction to your super fund and get their confirmation before lodging your tax return or making withdrawals, rollovers, or starting a pension.

- Use up Unused Contribution Limits: Haven’t used your full concessional contribution cap in recent years? You may be able to catch up using the carry-forward rule if your total super balance is under $500,000 on 30 June 2024. Unused limits from 2019-20 expire after 30 June 2025, so don’t miss out!

- Get a Tax Offset for Spouse Contributions: If your spouse earns less than $40,000, consider making an after-tax contribution to their super. By doing so, you can get up to a $540 tax offset while boosting their retirement savings.

- Grab a Government Co-Contribution: If you earn less than $60,400 and at least 10% comes from work or running a business, you could be eligible for a government co-contribution. All you need to do is add up to $1,000 to your super and the government may add up to $500 extra.

- Avoid the Division 293 Tax Trap: If your income (plus employer contributions) is over $250,000, you may pay an extra 15% tax on some of your super contributions. Strategies like bringing forward expenses or deferring income may help keep you below the threshold.

- Maximise Non-Concessional (After-Tax) Contributions: If you’re under 75, you may be able to contribute up to $360,000 in one year using the bring-forward rule. New rules from 1 July 2025 may allow you to contribute even more – speak with us about getting the timing right.

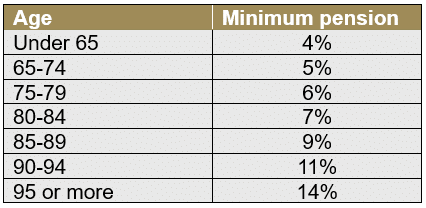

- Take your Minimum Pension Payment: If you’re drawing a pension from your super make sure you take the minimum amount by 30 June. Missing the minimum may affect your fund’s tax benefits for the whole year.

Conclusion

We’re here to support you with your EOFY tax and superannuation compliance. Contact Regency Partners to explore how we can assist with your current circumstances.