Splitting superannuation contributions to your spouse can be a great way to boost your combined superannuation balances which can benefit you both in retirement.

What is contribution splitting?

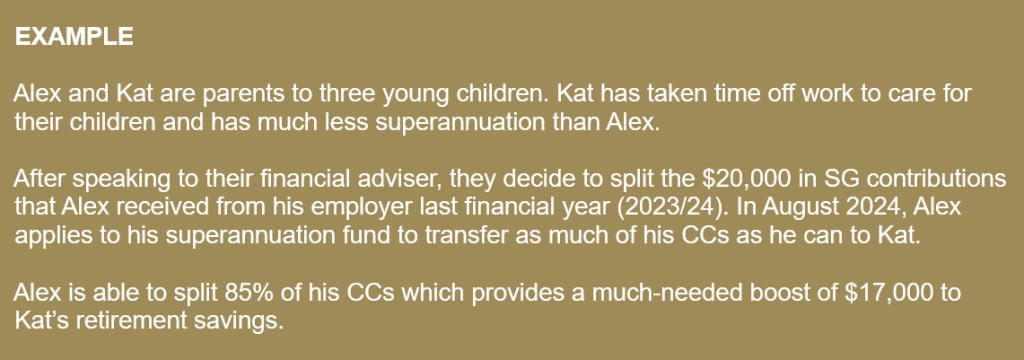

Spouse contribution splitting allows a couple to optimise their superannuation balances by splitting up to 85% of concessional contributions (CCs) they made or received in one financial year (ie, 2023/24) into their spouse’s account the next financial year (ie, 2024/25).

Remember, CCs are before-tax contributions and are generally taxed at 15% within your fund. This is the most common type of contribution individuals receive as it includes superannuation guarantee (SG) payments your employer makes into your fund on your behalf. Other types of CCs include salary sacrifice contributions and tax-deductible personal contributions.

The maximum amount that can be split to your spouse is the lesser of:

- 85% of CCs made in the previous financial year (i.e. 2023/24), and

- The CC cap for that financial year (ie, $27,500 in 2023/24).

Rules for the receiving spouse

An individual can apply to split their CCs at any age, but the receiving spouse must be either under preservation age (currently age 60 if born on 1 July 1964 or later), or aged between their preservation age and 65 years, and not retired at the time of the split request.

In other words, if the receiving spouse has reached their preservation age and is retired, or they are 65 years and over, the application to split your CCs will be invalid.

Benefits of contribution splitting

Contribution splitting is an effective way of building superannuation for your spouse and can manage your total superannuation balance (TSB) which can have several advantages, including:

- Equalising your superannuation balances to make best use of both of your “transfer balance caps” (TBC) which can maximise the amount you both have invested in tax-free retirement phase pensions. Note, the TBC limits the amount that a person can transfer to retirement phase pensions in their lifetime – this limit is currently $1.9 million in 2024/25.

- Optimising both of your TSBs to:

- Access a higher non-concessional (after-tax) contribution cap (as the amount you can contribute to superannuation depends on your TSB)

- Access the carry-forward CC rules and make larger CCs (note, the option_to utilise these rules is restricted to those with a TSB below $500,000 on the prior 30 June)

- Qualify for a government co-contribution

- Qualify for a tax offset for spouse contributions

- Boosting your Centrelink entitlements by transferring funds into a younger spouse’s accumulation account if your spouse is underage Pension age.

Conclusion

As always, there are eligibility requirements that must be met and deciding what is best for you will depend on your personal circumstances. For this reason, you may want to seek personal financial advice to determine whether contribution splitting is right for you and your spouse.