Tax file numbers (TFNs) are so much an everyday element when dealing with tax and the ATO that many taxpayers won’t give it a second thought when tax return software responds with an “invalid” message when a TFN is entered.

The common thought will be that it’s human error, so naturally one’s first reaction will be to check the numbers you entered, followed by carefully re-entering them.

Most of the time the problem will be fixed and it’s business as usual, but here’s a passing thought — how does the tax return software know what is, and what is not, a valid TFN? Especially when you consider that its validity or otherwise is not dependent on matching those numbers with someone’s name and/or birthday and/or address and so on. These identifiers are used to cross-check a person’s identity of course, but the initial validity of a TFN is known via another factor — the “TFN algorithm”.

This verification algorithm, also known as a check digit algorithm, is embedded in each unique TFN. As with a lot of these things, this is best explained using an example. However, you need to keep a number in mind, which in this case is the number 11.

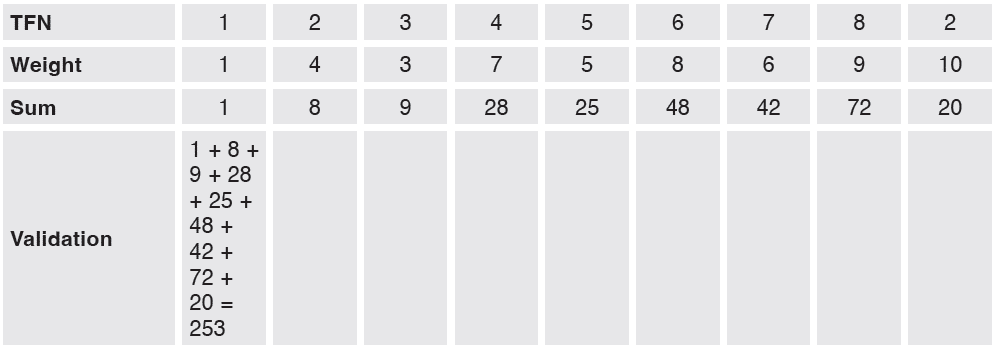

To make the algorithm work, a fixed weighting is applied to each number of the TFN. In order from the left, these weightings are 1, 4, 3, 7, 5, 8, 6, 9, 10.

Example: 123 456 782

See table below: as 253 is a multiple of 11, the TFN is valid.

To check for yourself, try the above table with your own TFN.

Conclusion

Understanding the secret life of TFNs sheds light on the intricate process of validating these crucial identification numbers. While many taxpayers may overlook the significance of TFNs and assume errors on their part when encountering “invalid” messages, the truth lies in the TFN algorithm.

This clever algorithm, with its unique weighting system, ensures the accuracy and legitimacy of TFNs without relying on personal information. By delving into the realm of TFN algorithms, you’ve gained insight into the complexity behind the scenes of tax return software.

Intrigued, want to know more, or need assistance? Contact our experienced team at Regency Partners.