Division 293 is a tax provision in Australia that imposes an additional tax on high-income earners’ superannuation contributions. When an individual’s adjusted taxable income exceeds $250,000, the Australian Taxation Office (ATO) applies an additional 15 per cent tax on all concessional (taxable) superannuation contributions made in that same tax year, including employer superannuation guarantee contributions. This additional tax brings the total tax payable on concessional superannuation contributions to 30 per cent.

This measure was implemented by the Australian Government to rectify the unequal tax treatment of high-income earners compared to other taxpayers concerning their superannuation contributions. The ATO typically issues the Division 293 tax assessment in the months following lodgement of the corresponding year’s Tax Return, and is named after Division 293 of the Income Tax Assessment Act 1997.

CALCULATION

The following calculation shows how we estimate the Division 293 Assessment:

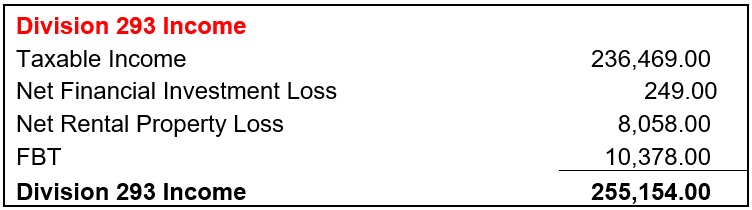

STEP 1 – Calculate Division 293 Income

The annual income threshold for Division 293 is $250,000 in adjusted income. Adjusted income is not just your taxable income, but also includes added back items, such as salary sacrifice, salary packaging and investment/rental losses. The ATO then adds your super contributions on to this to get the final income for Division 293. Below is a list of all the items included as income when calculating whether you’re liable for Division 293 tax:

- Taxable income (assessable income less any deductions)

- Employer and personal superannuation contribution amounts

- Reportable fringe benefit amounts

- Net financial and rental investment losses

- Work-related compensation payments

- Amounts on which family trust distributions tax have been paid

- Some components of employment termination payments (ETP)

- Some components of super lump sum payments

FINANCIAL YEAR 20XX

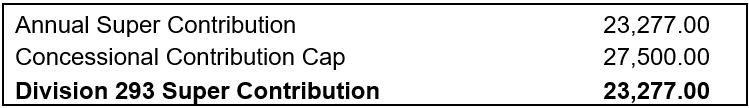

STEP 2 – Calculate Division 293 Super Contribution

Determine the annual super contribution made by the individual. This includes both employer and personal superannuation contributions. The maximum concessional contribution cap for the year is $27,500.

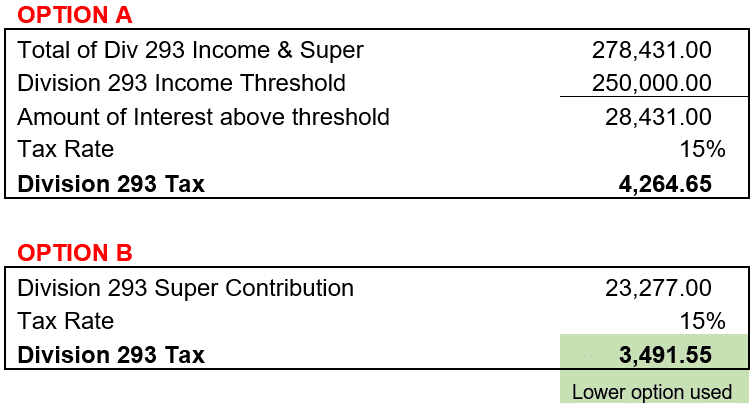

STEP 3 – Calculate Total of Division 293 Income and Super

Add the Division 293 income and the Division 293 super contribution to obtain the total.

STEP 4 – Calculate Division 293 Tax

The Division 293 tax is calculated based on 15% on the lesser of two amounts:

- OPTION A: The amount earned is excess of the annual threshold, or

- OPTION B: Concessional (i.e. pre-tax) super contributions

The Division 293 tax payable is the lower amount between Option A and Option B.

The ATO uses the details reported on your tax return and the superannuation contributions reported by your super fund/s to assess whether you’re liable for Division 293 tax.

How do you know if you will be required to pay Division 293 Tax?

Once your individual tax return has been lodged and the ATO has received concessional contribution information from any superannuation funds you may have, the ATO will assess whether any Division 293 Tax is payable.

Although the assessment is issued to the individual, there are two options available to make payment:

1. Pay personally via your Income Tax Account with the ATO

2. Elect to release the amount from your superannuation fund

Conclusion

If you have any questions about Division 293 and how it may affect you, our experienced team at Regency Partners is here to help. We can assist you in requesting a release from your superannuation funds for any Division 293 assessments mentioned above.