Keeping track of your superannuation balance is crucial for understanding your eligibility for various superannuation concessions and measures. In this blog article, we will explore how myGov, the Australian government’s online portal, can assist you in tracking your superannuation balance and accessing important information related to your superannuation account.

Understanding total superannuation balance (TSB)

Your Total Superannuation Balance (TSB) is a significant factor that determines your eligibility for several favorable superannuation-related measures. These measures include the Bring Forward Non-Concessional Contribution (NCC) cap, Carry Forward Concessional Contributions, Superannuation Spouse Tax Offset, Government Co-contribution, and more. Your TSB consists of your superannuation accumulation account balance(s), superannuation pension account(s), and the outstanding limited recourse borrowing arrangement amount in your SMSF, under certain circumstances.

Measuring TSB and its impact

Your TSB for the current year is calculated on 30 June of the previous financial year (e.g. 30 June 2023) to determine your eligibility for making or receiving specific types of superannuation contributions. It’s important to keep track of your TSB as it affects how much you can contribute to superannuation and whether you qualify for various superannuation concessions and measures.

How to check your TSB

There are two primary methods to track your TSB. Firstly, you can contact your superannuation fund or review your fund’s statements and records to find your TSB. Your fund’s annual statement typically reports the TSB figure to the Australian Taxation Office (ATO), referred to as the ‘exit value’ or ‘withdrawal benefit.’ Please note that this figure may differ from the 30 June ‘closing balance.’

The second method involves accessing your myGov account, which provides your TSB for the previous 30 June, along with other valuable information. By logging into your myGov account at my.gov.au, you can view your TSB, eligibility for the NCC bring forward arrangement, concessional contribution cap, unused carry forward concessional contribution cap amounts accrued since 1 July 2018, employer contributions, and more. Checking this information is beneficial to avoid exceeding your contribution caps when making further contributions before 30 June 2024.

Steps to track your TSB using myGov

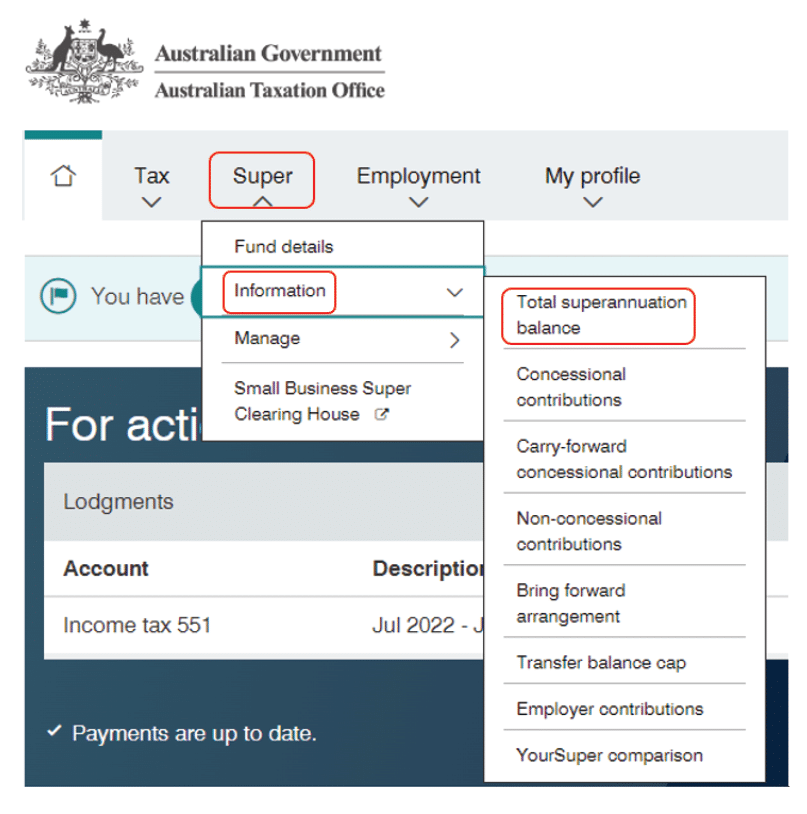

- Visit my.gov.au and log into your myGov account. If you don’t have an account, you can create one. If you have a myGov account but haven’t linked the ATO service, you can link it during this process.

- Select the “super” tab, then click on the information option, and choose “total superannuation balance.” This section will display your current TSB recorded by the ATO.

- To review your TSB for each superannuation interest you hold, including the TSB from the previous year’s 30 June, click on the “History” button.

Considerations and assistance

While checking your TSB and other amounts displayed on myGov, it’s important to exercise caution. Depending on the type of superannuation fund you have, your 30 June balance and contribution details might not have been reported to the ATO yet. For example, self-managed superannuation funds (SMSFs) are not required to report their information to the ATO as frequently as large APRA-regulated funds. Consequently, the contributions and account balance in myGov may not be up to date for SMSFs. In such cases, SMSF members should rely on their SMSF records to track their TSB and contribution caps if the information is not current in their myGov account.

If you need more information on how to check your TSB or have further inquiries about your superannuation account, please don’t hesitate to contact us. We are here to provide the necessary support and guidance.

Conclusion

Tracking your superannuation balance, particularly your Total Superannuation Balance (TSB), is crucial for understanding your eligibility for various superannuation concessions and measures. Utilising the myGov portal allows you to conveniently access your TSB, contribution caps, and other important superannuation information. By staying informed about your superannuation, you can make informed decisions and optimise your financial future.

Contact our team of experts for more information and to discuss your specific needs.