As the end of the financial year approaches, individuals who aim to maximise their superannuation contribution caps must pay careful attention to the timing of their contributions. Recent court cases and the Australian Taxation Office’s (ATO) guidelines have emphasised that contributions are considered to be made when they are received by the superannuation fund, rather than when they are initiated. This blog article will highlight the importance of contribution timing and provide essential information to help individuals make informed decisions.

Lessons from a recent court case

A recent court case, Mackie v Commissioner of Taxation [2024] AATA 619, has reinforced the significance of contribution timing. In this case, a member intended for contributions made in late June to be attributed to the same financial year. However, the ATO and the Administrative Appeals Tribunal ruled that contributions are deemed to be made on the dates they are received by the superannuation fund. This ruling resulted in the member exceeding their contribution caps as the contributions were deemed to belong to the next financial year.

The ATO’s view on contribution timing

According to the ATO’s Taxation Ruling TR 2010/1, a contribution is considered made when the capital of the fund is increased. This occurs upon the receipt of an amount, the acquisition of asset ownership, or when the fund otherwise obtains the benefit of an amount. For example, if a contribution is made via electronic transfer, it is considered made when the amount is credited to the superannuation fund’s bank account, not when the payment is initiated.

Understanding contribution timing methods

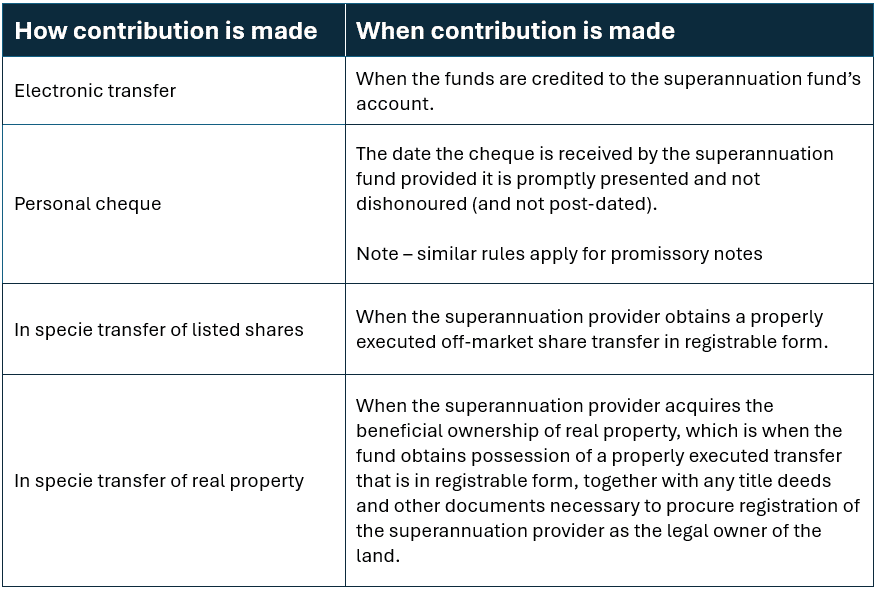

To provide clarity on different contribution timing scenarios, the following table summarises some common ways of transferring funds and when contributions are deemed to be made. Please note that this list is not exhaustive.

The importance of timing

Given that 30 June falls on a non-business day this year, individuals should avoid making last-minute contributions over the weekend, as transfers typically occur on business days. Members of large APRA-regulated superannuation funds must be aware of the cut-off day set by their fund, as contributions received after this date may not be allocated to the current financial year. Contributions received by your fund on 1 July 2024 will be considered part of the 2024-25 financial year.

Considerations for SMSFs

For those with a Self-Managed Superannuation Fund (SMSF), electronic transfers between accounts within the same bank usually occur immediately, allowing contributions to count towards the current financial year. However, transfers between different banks may take longer to process, potentially resulting in contributions being received by the SMSF in the next financial year.

Superannuation clearing house delays

Individuals should exercise caution if their employer utilises a superannuation clearing house for contributions. There can be a time delay between when the employer’s payment is made to the clearing house and when the superannuation fund receives the contribution. Contributions made through a clearing house are not considered received by the fund until they are actually received, potentially causing contributions to be recorded in the next financial year.

Conclusion

To ensure contributions are received by the superannuation fund in the current financial year, it is crucial to allow plenty of time before the 30 June deadline. Contributions should be made well in advance, as they are deemed made when received by the fund, not when the transaction is processed. Understanding the timing implications and potential delays associated with different contribution methods can help individuals avoid exceeding their contribution caps and maximise their superannuation benefits.

By taking care with contribution timing, individuals can effectively manage their superannuation contributions and make the most of the available opportunities in the current financial year.