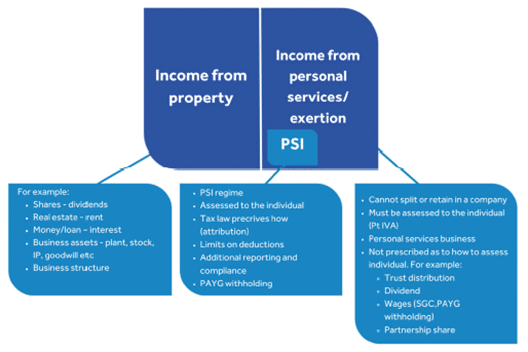

When it comes to classifying income, understanding the distinction between income from property and income from personal services is essential. Income from property is derived from assets or the sale of goods, while income from personal services primarily reflects compensation for an individual’s efforts, skills, or labour. To illustrate this concept, consider the example image below, which outlines different sources of income and their categorisation.

Examples of Personal Services Income (PSI) and non-PSI income

To illustrate the concept, let’s consider Susan, a management consultant operating as a sole trader.

- Contract 1:

Susan provided a 1-hour training course for a client. She charged $1,000 for her course. This included training materials that cost $100. Since $900 (90% of the contract) is for her skills and expertise, this is PSI. Susan can report $1,000 as PSI. - Contract 2:

Susan provided management software for a client. She charged $10,000 in total. This included $8,000 to cover the cost of the software licence. Since $2,000 (20% of the contract) is for her skills and expertise, this is not PSI. Susan cannot report PSI for this contract.

It is essential to understand the distinction between PSI and non-PSI income, as your taxable income can consist of a mix of both.

Understanding PSI regulations

The purpose of PSI regulations is to treat individuals who earn income from their own labour similarly to employees. These regulations also impose restrictions on the deductions you can claim. For instance, if PSI guidelines are in effect, you may not be able to make the following claims against PSI:

- Rent for your home (or the home of an associate), mortgage interest, rates, or land tax

- Payments made to your spouse or partners for non-principal work such as secretarial duties, which you normally would not be allowed to deduct as an employee.

Determining compliance with the Personal Services Income (PSI) rules is the next crucial step if you earn Personal Service Income. These rules significantly impact the basic reporting requirements and deductions available to you.

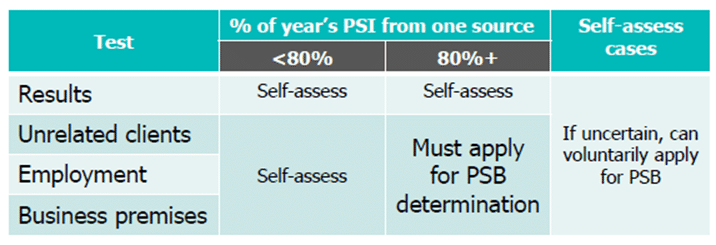

How the tests operate

To determine compliance with PSI rules, two primary criteria must be met: the results test and the 80% test. The results test assesses the outcome of the work performed, while the 80% test examines factors such as client relationships, business premises, and employment arrangements. Failing these tests may require you to seek a Personal Services Business (PSB) determination.

The personal service income tax is a complex topic that requires careful consideration. Before classifying income as personal service income (PSI), it is crucial to understand the various intricacies involved. Additionally, it is important to evaluate whether your primary motivation for engaging in the activity was to generate income. If financial gain was a significant factor, it increases the likelihood of encountering challenges related to the treatment of PSI.

Common errors and the importance of professional assistance

Calculating personal services income accurately can be challenging, and errors can lead to overpayment of taxes. Mistakenly classifying earnings as PSI often occurs when:

- personal expenses are incorrectly charged to business accounts (i.e. clothing and food)

- tax software is used without professional advice

- deductions are mismanaged.

Additionally, miscalculating capital gains or losses and firm expenses can result in inaccuracies. To ensure compliance and optimise your tax position, it is crucial to rely on a trusted tax professional.

Conclusion

Navigating the complexities of personal services income is vital to avoid tax pitfalls and ensure compliance with regulations. Regency Partners is committed to providing expert guidance and assistance in understanding and managing PSI. By partnering with us, you can rest assured that your tax matters are handled accurately, allowing you to focus on growing your business. Contact us today to discuss your specific needs and benefit from our expertise in personal services income taxation.